Contents:

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The Panic of 1796 to 1797 led to the collapse of multiple prominent merchant firms in several major American cities as well as the imprisonment of many American debtors.

Banking stocks sold off sharply Wednesday as concerns about the sector’s resilience in the wake of Silicon Valley Bank’s demise spread beyond the United States. Troubles at Switzerland’s second-biggest lender have sparked fears that banking turmoilis spreading around the world after the failure of two US banks. Yet the European Central Bank hiked rates by a half point to fight inflation, sending a signal that central banks like the Federal Reserve may not budge in their rate hiking campaigns. Investors’ bets on whether the Fed will raise interest rates when it meets next week tilted back to expecting a quarter-point increase, after briefly flirting with no change, still markedly lower than where expectations stood a week ago.

Khudairy added that there has been no discussion about the Swiss bank needing more capital or requiring assistance. “The red line we have is 9.9%. We will not go above that. To our knowledge, they are not looking for capital.” “Markets are skittish and they’re looking for stories or things that validate concern,” said Saudi National Bank Chairman Ammar Al Khudairy in a Thursday interview with CNBC.

The coronavirus-led sell-off put an end to the eleven-year bull run in stock markets, sending some of them into bear market territory – creating fear among some but opportunity for others. On Aug. 8, 2011, the U.S. and global stock markets fell as a weakening U.S. economy and a widening debt crisis in Europe dampened investor confidence. Before this event, the U.S. received a credit downgrade from Standard & Poor’s (S&P) for the first time in history amid an earlier debt ceiling impasse. Although the political gridlock was ultimately resolved, S&P saw the agreement as falling short of what was needed to repair the nation’s finances. Black Monday causes include an increase in international investors’ activity in U.S. markets. Trade-clearing protocols were overhauled to instill uniformity in all prominent market products.

The 3 Best EV Stocks to Own for the Next Decade

The month progress of the price growth could be smashed by one day of a fall. These strong movements are provoked by a number of factors, but the panic mood of the market participants play an important role in it. Jitanchandra is a financial markets author with more than 15 years experience trading currencies, indices and US equities. The yellow boxes in the chart below show some but not all of the instances where the long and short rules have been met.

During a prolonged stock market panic, many investors tend to perform a sector rotation of their portfolio. This involves rebalancing a stock portfolio into sectors that typically perform better in such conditions. For example, if the stock market panic is due to the potential of an economic recession investors may choose to invest in defensive stocks. So far, we have covered some of the strategies available to short sell in a market panic and potentially profit from falling asset prices. However, falling asset prices can lead to another strategy of finding undervalued or low price stocks which are covered in the third strategy of how to invest in a market panic. Silicon Valley Bank was focused for decades on lending to and gathering deposits from the venture-capital community.

Some setups did continue to go in the direction of the trade and others did not. It is inevitable to have losing trades when the market changes direction or market condition. This is why using stop losses and proper risk management techniques are important.

With tech stocks under huge selling pressure, the Nasdaq was the first index to hit correction territory last week, now down around 15% from its record highs last November. The credit rating agency is the latest to downgrade or threaten a downgrade of a regional bank’s credit. Fitch and S&P Global Ratings downgraded First Republic Bank’s credit rating Wednesday onconcernsthat depositors couldpull their cashdespite federal intervention to restore faith in the banking sector. https://day-trading.info/ As mortgage rates trended lower from November through January, builders have begun to feel more optimistic that conditions may improve in 2023. But recent strong economic data and uncertainty in the banking sector mean that inflation concerns remain, along with volatile mortgage rates. The commodity market is popular with many traders, partly because of the high levels of volatility which can be present, allowing traders to profit from both rising and falling prices.

Contemporary US Stock Market Crashes

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The ‘shooting star candle’ formation is where buyers push the share price but cannot hold onto the gains, allowing sellers to take control and push the market back down with the open and closing price in the lower third of the candle. In this situation, traders could have placed an order to sell, if and when price from the open of the next day breaks below the low of the shooting star candle (€11.765).

The first thing to point out is that a bank holding company and a bank are different things. The Federal Deposit Insurance Corp. provides insurance on failed banks’ deposits, up to certain limits, through a pool that is funded by banks based on their asset sizes. The October effect refers to a perceived market anomaly that stocks tend to decline in October, based on the fact that crashes, such as the Wall Street crash of 1929 and Black Monday occurred during this month. In fact, over the last 20 years, October has been one of the best months for stock growth. The Kennedy slide of 1962 was a flash crash, during which the DJIA fell 5.7%, its second-largest point decline ever at that time.

When the market reopened on Monday, investors had largely shrugged off the prior week’s plunge and had one of the heaviest trading days on record. This event was considered a mini-crash since the percentage loss was relatively small, particularly in comparison to the other crashes listed here. A selling panic had begun and the following week, on Oct. 28, the Dow declined approximately 13%. The crash lasted until 1932, resulting in the Great Depression, a time in which stocks had lost nearly 90% of their value.

And this could influence profit registration at the end of the month by open positions and accumulation of new positions at the beginning of a new month. When the state of a trend or disbalance emerges, the market leaves the Value Area. In some cases, a strong trend could be caused by the growth of panic moods. This indicator also shows the maximum volume level for the selected period. Open the Market Watch window by selecting View from the menu at the top of the platform or by pressing Ctrl+M on your keyboard. This will open up a list of tradable symbols on the left side of your chart.

- Because of this risk of default, investors require a higher yield from junk bonds.

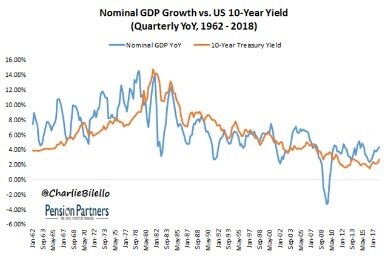

- This record-level of buying is a reflection of how out-of-whack the financial markets are today.

- Black Monday causes include an increase in international investors’ activity in U.S. markets.

- The DJIA lost over $500 billion after dropping 22.6%, the largest one-day stock market decline in history.

It was really more a natural correction of some folks trying to take profits,” said Omar Aguilar, senior vice president and chief investment officer of passive equity and multi-asset strategies at Charles Schwab. The October effect is a theory that stocks tend to decline during the month of October. This supposed market anomaly, however, has little in the way of data to support it. The dot-com bubble formed as a result of a surge of investments in the internet and technology stocks. By December of 2000, that same index had lost more than half of its value when the bubble burst and wouldn’t fully recover until early 2017. Black Friday occurred on Sept. 24, 1869, and saw the collapse of the gold market after two speculators, Jay Gould and Jim Fisk, concocted a scheme to drive up the price of gold.

Saudi National Bank says panic over Credit Suisse is ‘unwarranted’

Laszlo Birinyi, who began analyzing the market with Salomon Brothers back in 1976, says a correction happens whenever the market crosses the 10 percent border, whether it’s at the end of the trading day or in the middle of it. That said, for investors, it’s worth remembering that since the stock market hit bottom in March 2020, the S&P 500 rose 114.4 percent through Jan. 3. Compared with that stupendous increase, the market’s decline since then has been inconsequential. Europe’s main markets have opened higher after moves from the Swiss central bank reassured investors over the financial health of Credit Suisse. Freddie Mac is set to release its average weekly mortgage rates at 12 p.m.

Despite the fact that panic is an abnormal human state, a panic fall in the market could be considered a standard phenomenon. Take profits, but to accompany a trade moving a stop loss behind extreme points of new days. These two days were characterised with trend candles with minimum shadows, which testified to the strength of bears. If there is negative news, which may provoke panic movements, then you need to track the daily time-frame with respect to the market exit from the balance state. Always trade in accordance with the current market state in order to avoid big losses during strong crisis movements.

What was the Wall Street crash of 1929?

If the market is in balance within the Dynamic Levels indicator lines, you can both sell and buy. It is believed that the market is ‘at rest’ when the price fluctuates within the Value Area. Analysis of trading levels with the help of the Dynamic Levels indicator. Markets are an extension of human emotions and excitement and all feelings, including panic, could be revealed here. Receive free real-time market data, with no delays, at no extra cost. A screenshot showing the MetaTrader 5 Supreme Edition platform provided by Admirals and the Technical Insight Lookup tab for Apple shares.

“Moral hazard” is somewhat academic shorthand for the idea that banks will take on more risk if they believe that they will ultimately be bailed out. Investors have been on edge over whetherthe collapse of Silicon Valley Bank in the United Statescould spark a banking crisis that would hurt the global economy. If it prompts tighter lockdowns, it could force factories to shutter, exacerbating shortages of everything from cars to building materials. Even as case counts reached their highest levels ever, the stock market continued on a steady climb, bolstered by optimism behind the rollout of vaccines. His comments come hours after Credit Suisse announced that it is taking “decisive action” to borrow up to 50 billion Swiss francs ($53.68 billion). The lender’s shares plunged Wednesday after a report that the Saudi bank said it could not provide Credit Suisse with any further financial assistance.

Our Coverage of the Investment World

Shares of Western Alliance, a regional bank like SVB, fell 10% in premarket trading. PacWest Bank fell 16%, and shares of other regional banks fell again, too. JPMorgan said in a note to clients that the Swiss central bank’s intervention was insufficient, and Credit Suisse will most likely need to be taken over.

The roles Goldman Sachs played in the final days of Silicon Valley Bank – Yahoo Finance

The roles Goldman Sachs played in the final days of Silicon Valley Bank.

Posted: Wed, 15 Mar 2023 00:09:00 GMT [source]

News of a heavily mutated Covid variant, now named “Omicron,” terrified the market on Friday. This paper reviews the events surrounding the crash and discusses the response of the Federal Reserve. This is a brief history of the 1929 crash at the EH.net project from the Economic History Association. The 1873 panic was born of a boom in railway construction in the United States had spurred a bull market.

The decline of the stock and bond markets this year has been painful, and it remains difficult to predict what is in store for the future. Wall Street’s worries eased on Tuesday, as investors took comfort from signs that a potential banking crisis appeared contained and bet on a more supportive environment for the economy going forward. By this weekend, there will be a flood, initiating an emotional shift. As in the past, they will produce feelings of fright and remorse among the multitude with fully-invested investors.

European markets open higher after Credit Suisse takes up Swiss central bank support

MORE FROM FORBES The Stock Market Selling Storm Is Over – Time To Buy By John S. TobeyCan you feel it? It flips investors’ wants upside-down, making financial spread betting companies top 10 brokers risk-reduction (i.e., selling) the desirable action. Use the Dynamic Levels indicator to understand whether there is panic in the market.