Contents:

In addition to beating the Street’s prediction of EPS of -$1.57, the the importance of other comprehensive income reported a loss per share of $1.53. Decisions on automation and production systems are usually based on the relative costs of alternatives. In this section we examine how these costs and cost factors are determined.

The statistics for the second quarter of fiscal 2023 showed that the integration of the new addition appeared to be going smoothly . Meeting Wall Street projections, revenue surged by 70% year over year to a record $1.37 billion, with organic revenue growth up 23%. The corporation also reported a backlog of $2.9 billion, an increase of 68% from the previous year. EPS of $0.95 surpassed the analysts’ expected $0.93 for the bottom line.

Harsha Engineers IPO Explained in 10 Important Points

You will find several positive reviews by desertcart customers on portals like Trustpilot, etc. The website uses an HTTPS system to safeguard all customers and protect financial details and transactions done online. The company uses the latest upgraded technologies and software systems to ensure a fair and safe shopping experience for all customers.

They include world-class casinos and hotels, live and theatrical performances, as well as a variety of nightlife and shopping opportunities. Bellagio, MGM Grand, ARIA, and Park MGM are just a few of the well-known resort brands on its roster. In total, the corporation has 29 different hotels and gaming options across the US and Macau.

Coherent

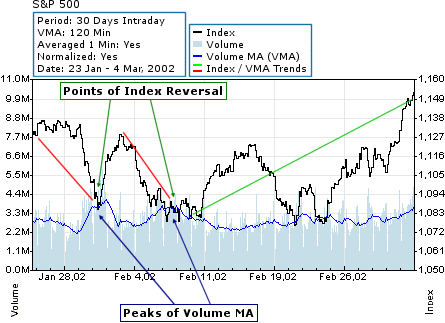

View the COHR premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Coherent Inc real time stock price chart below. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the COHR quote.

https://1investing.in/ IPO will be Open on 28 September 2022 and closes on 30 September 2022. The company has fixed the price of this IPO at ₹40 according to the face value of ₹10. The company will raise ₹24.00 Crores through this IPO under the 60,00,000 Equity Shares public issue. You can check here to know Lloyds Luxuries IPO GMP and Lloyds Luxuries IPO subscription status here. Yes, it is absolutely safe to buy Mary Cohr Instant Anti Redness Cream from desertcart, which is a 100% legitimate site operating in 164 countries. Since 2014, desertcart has been delivering a wide range of products to customers and fulfilling their desires.

Burry went short at that time and hasn’t held back in delivering repeated cautions over the status of the market. Lloyds Luxuries IPO allotment status is now available on Bigshare Services’ website. Lloyds Luxuries IPO Total Reservation of 60,00,000 shares are to be bid for the public issue by Lloyds Luxuries IPO with – for QIB and 28,50,000 for NII 28,50,000 For RII & – Shares EMP.

A “Cheap” Technology Stock To Target Buying – TheStreet

A “Cheap” Technology Stock To Target Buying.

Posted: Thu, 16 Feb 2023 08:00:00 GMT [source]

India’s first semi-high-speed regional rail services have been named ‘RAPIDX’ by the National Capital Region Transport Corporation , officials said on Tuesday. The trains will run on the Regional Rapid Transit System corridors, being implemented to connect key urban nodes across the National Capital Region , they said. Shoigu and his Indian counterpart Rajnath Singh are expected to meet on the sidelines of the SCO meet to discuss delay in supply of defence equipment and payment issues through national currencies. This info isn’t a recommendation for what you should personally do, so please don’t take the data as investment advice.

‘Big Short’ investor Michael Burry’s latest portfolio filings reveal new bets on Chinese e-commerce stocks

Get live Share Market updates and latest India News and business news on Financial Express. Michael Burry’s latest Form 13F filings reveal that the fund has sold all but two of its previous six holdings, leaving only Geo Group and Qurate Retail. Overall, Burry increased the number of US stock positions in its portfolio from six to nine, and its overall value increased by 13% to around $47 million.

Coherent, a leader in laser system development, is the first Burry-backed stock we’ll examine. As a designer and manufacturer of precision equipment, the company is well-known in the fields of engineered materials and optoelectronic component systems. Although the business has supplied this void ever since it was created in 1971, the name and ticker are rather recent. The company, which was formerly known as II-VI, purchased Coherent in July and changed its name.

Uma Converter IPO Review – Subscribe or Avoid?

Coherent, Inc. provides lasers and laser-based technology in a range of scientific, commercial, and industrial applications worldwide. It operates through two segments, Specialty Lasers and Systems, and Commercial Lasers and Components. The company designs, manufactures, services, and markets lasers, laser tools, precision optics, and related accessories. Its products are used in markets, such as microelectronics, materials processing, original equipment manufacturer components and instrumentation, and scientific research and government programs.

Despite A Drop In Sales, Coherent Stock Has Managed To Strongly Outperform The S&P 500 – Forbes

Despite A Drop In Sales, Coherent Stock Has Managed To Strongly Outperform The S&P 500.

Posted: Tue, 05 Jul 2022 07:00:00 GMT [source]

The company markets its products through a direct sales force in the United States, as well as through direct sales personnel and independent representatives internationally. Coherent Inc. was founded in 1966 and is headquartered in Santa Clara, California. Direct labor cost, which we will use here to illustrate how overheads are allocated and subsequently used to compute factors such as selling price of the product.

The allotment will be finalized on 06 October 2022 and the IPO may list on 11 October 2022. This is an exclusive story available for selected readers only. Scion Asset Management, led by Michael Burry, filed its 13F form with the SEC detailing the hedge fund’s positions at the end of Q4. “Emergency assistance” care which camouflages, purifies and dries out imperfections, soothing excessive sensitivity thanks to its oil-free tinted cream texture.

The trouble with overhead rates as we have developed them here is that they are based on labor cost alone. A machine operator who runs an old, small engine lathe whose book value is zero will be costed at the same overhead rate as an operator running a new CNC turning center just purchased for $500,000. Obviously, the time on the machining center is more productive and should be valued at a higher rate.

Despite this, he continues to invest in the stocks he believes can withstand any bad circumstances that may come along. The minimum bid is3000 Shareswith₹120,000amount while the maximum bid is3000 shareswith₹120,000. There are two ways to apply inLloyds Luxuries IPO. You can apply forLloyds Luxuries IPOthrough ASBA available in your bank account.

- The price-earnings ratio is a company’s share price to the company’s Earnings per Share.

- The company own exclusive rights to open stores in the brand name of “MARY COHR” either directly or through sub franchisee arrangements in India.

- Although ADS and ADR are traded on US stock exchanges, they represent ownership in foreign-listed companies.

- The brand is exclusively owned by Truefitt & Hill (Gentlemen’s Grooming) Limited, a company registered under the law of England and Wales and having its office in London, United Kingdom.

- Coherent Inc share price live 34.34, this page displays NYSE COHR stock exchange data.

Cohr Private Limited is a Non-govt company, incorporated on 18 May, 1995. It’s a private unlisted company and is classified as’company limited by shares’. Enterprise Value is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization.

You have to go to your online bank login and select Lloyds Luxuries IPO in the Invest section and apply through your bank account. Another option is you can apply Lloyds Luxuries IPO through IPO form download through NSE and BSE. See theLloyds Luxuries IPO Form– Download the NSE Form and BSE Form IPO Form, fill it, and submit it to your bank or your broker. Lloyds Luxuries IPO Date is 28 September 2022 and closes on 30 September 2022.

If differences in rates of different production machines are not recognized, manufacturing costs will not be accurately measured by the overhead rate structure. The factory overhead rate is 250% and the corporate overhead rate is 600%. Lloyds Luxuries IPO description– The company is into salon services and beauty products in India, focused on grooming men to perfection. It owns exclusive franchisee of Truefitt & Hill, which is an international brand offering a wide range of beauty products and salon services for men. Lloyds Luxuries began its relationship with Truefitt & Hill in 2013 and has subsequently expanded its operations to 14 barber stores under the brand as of 31 March 2022.